Annuity calculator with solution

Use this income annuity calculator to get an annuity income estimate in just a few steps. At The Annuity Expert our mission isnt to find you a good solution.

Annuity Contracts For Investment Or For Creating Income Stream Annuity Annuity Formula Accounting Principles

The annuity is not guaranteed by any bank or credit union and is not insured by the FDIC or any other governmental agency.

. The present value interest factor of annuity calculator takes no time in calculating PVIFA value. The amount of annuity that you want to receive from your pension. Annuity-based lottery payouts work the same way as common immediate annuitiesMore specifically lottery annuity payments are a form of structured settlement where the scheduled payments are 100 percent guaranteed by the lottery commission.

Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time. The table below gives you an idea of how much those explicit costs might run you. An online insurance premium calculator is a free tool which calculates the insurance premium based on data such as age policy term premium.

Relevance and Uses of Average Formula. If we invest a sum of money in a bank at 5 interest per year how many years and months are required to get our money double the value. Variable annuities can be a viable solution for those who are willing to stay invested in stock-like markets but need guaranteed income living benefit or death benefit tied to their annuity.

Use the following data can be used for the calculation Present Value of Lumpsum Amount P. Many companies and organizations use average to find out their average sales average product manufacturing average salary and wages paid to labor and employees. Annuities are intended as long-term savings vehicles.

It will instantly provide you the PVIFA value based on the input given by the user. Expected Annuity Rate- Enter the expected annuity rate ie. In general lottery annuity payments consist of an initial payment and a number of gradually increasing annual.

105L145V02 keeping yourself as the Life Assured and your child as the nominee. You can assume that the annuity is paid at the end of the year. Presenting ICICI Prudential Smart Kid Solution with ICICI Pru Smart Life a Unit Linked Insurance Plan which grows your investments and helps you secure the educational milestones of your children.

Some annuities may go down in value. 25 Rate of Interest r. Double the Money Practice Problems.

Thrift Savings Plan TSP You are under FERS if. Once you enter all the details the National Pension Scheme calculator will simultaneously calculate the estimated lump-sum amount and pension amount you will receive at the time of maturity. Average 12104 Average sales for months is 12104.

For this solution you have to purchase ICICI Pru Smart Life UIN. If we invest a sum of money in a bank at 05 interest per month how many years and months are required to get our money double the value. Average 60520 5.

If youre interested in buying an annuity or selling your annuity or structured settlement payments we will connect you with one of our trusted financial partners for a free quote. 10000000 Number of Periods n. What is the monthly payment on a mortgage of 12000 with annual interest rate of 55 that runs for 10 textyears.

Use Tata AIA life insurance premium calculator to understand how much life insurance is needed. The purchase of an annuity is not a provision or condition of any bank or credit union activity. This type of approach does take considerably more time effort and analysis which will show you mathematically the successful possibilities by comparing various outcomes rather than trying to sell or convince you of that so-called one best solutionClients frequently tell us that this process removes some of the confusion and emotion to help them objectively identify a better.

Identify and write down the values of interest rate and the number of period. The Federal Employees Retirement System FERS is a three-tiered system that includes. For example a fixed index annuity with a guaranteed lifetime rider can range from 1 to 3 of the contract value.

I strive to take the guesswork out of retirement planning and finding the best insurance coverage at the cheapest rates all at no cost to you. Many clients purchase income annuities to help cover their essential expenses as defined by them in retirement. Our mission is to find you the perfect solution.

Though the average cost of a variable annuity is 23 costs can exceed 3.

Present Value Of An Annuity How To Calculate Examples

Accounting For Leases Mgt680 Lecture In Hindi Urdu 28 Youtube Accounting Notes Accounting Lecture

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of Annuity Due Formula Calculator With Excel Template

Deferred Annuity Formula Calculator Example With Excel Template Annuity Formula Accounting And Finance Resume Writing

Download Future Value Calculator Excel Template Exceldatapro Excel Templates Financial Analysis Templates

Present Value Of Annuity Formula Calculate Pv Of An Annuity

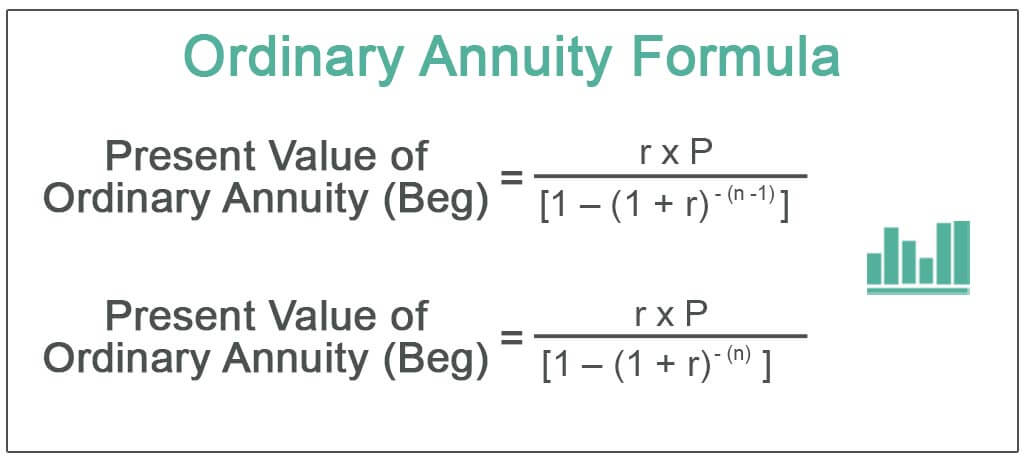

Ordinary Annuity Formula Step By Step Calculation

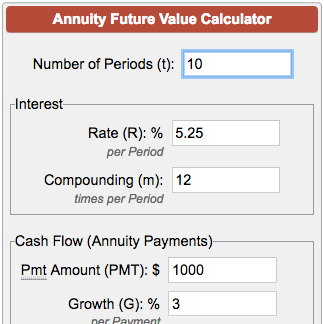

Future Value Of Annuity Calculator

Annuities How To Calculate The Future Value Of An Annuity Due Youtube

Future Value Of Annuity Calculator

What Is An Annuity Table And How Do You Use One

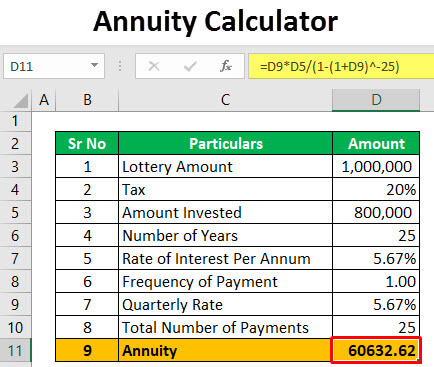

Annuity Calculator Examples To Calculate Annuity

Future Value Of An Annuity Formula Example And Excel Template

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Present Value Of An Annuity How To Calculate Examples

All About Annuities Your One Step Portal To Everything You Need To Know About Annuities Annuity Gold Peak Tea Tea Bottle